Should I Consider a ROTH Conversion? “Mega”…”Backdoor”….or Otherwise?

By: Brian Seay, CFA

ROTH conversions are one of the most common questions I receive from clients. Everyone assumes that if a “back-door” loophole exists, they should take advantage of it. Maybe…or maybe not.

Guiding Principle: Pay taxes on income when your tax rate is relatively low!

You pay taxes on the income you contribute to a ROTH and on the distributions, you receive from a traditional 401k or IRA. Neither are “tax-free,” but the timing of taxes is very different, and that is where the opportunity lies.

For ROTH accounts, you pay taxes on the contributions now in exchange for future tax-free growth. For Traditional IRA and 401k contributions, you receive a tax deduction now but owe taxes on distributions in the future. The goal is to pay taxes on the income when your tax rate is the lowest. That means you need to 1) understand your current tax rate and 2) project your future tax rates.

If you are in a relatively low tax bracket now, then ROTH contributions and conversions may be appropriate. If you are in a relatively high tax bracket now, then it may be beneficial to make traditional IRA or 401k contributions and receive a current tax deduction.

Often, I talk to clients that skip the projection part above and want to head straight into a complex conversion or transfer. Without understanding your tax situation, you may be doing a conversion that is at best, not useful or at worse, increasing your taxes! This applies whether you are working or are already in retirement. So don’t put the cart before the horse.

How Conversions Reduce Taxes:

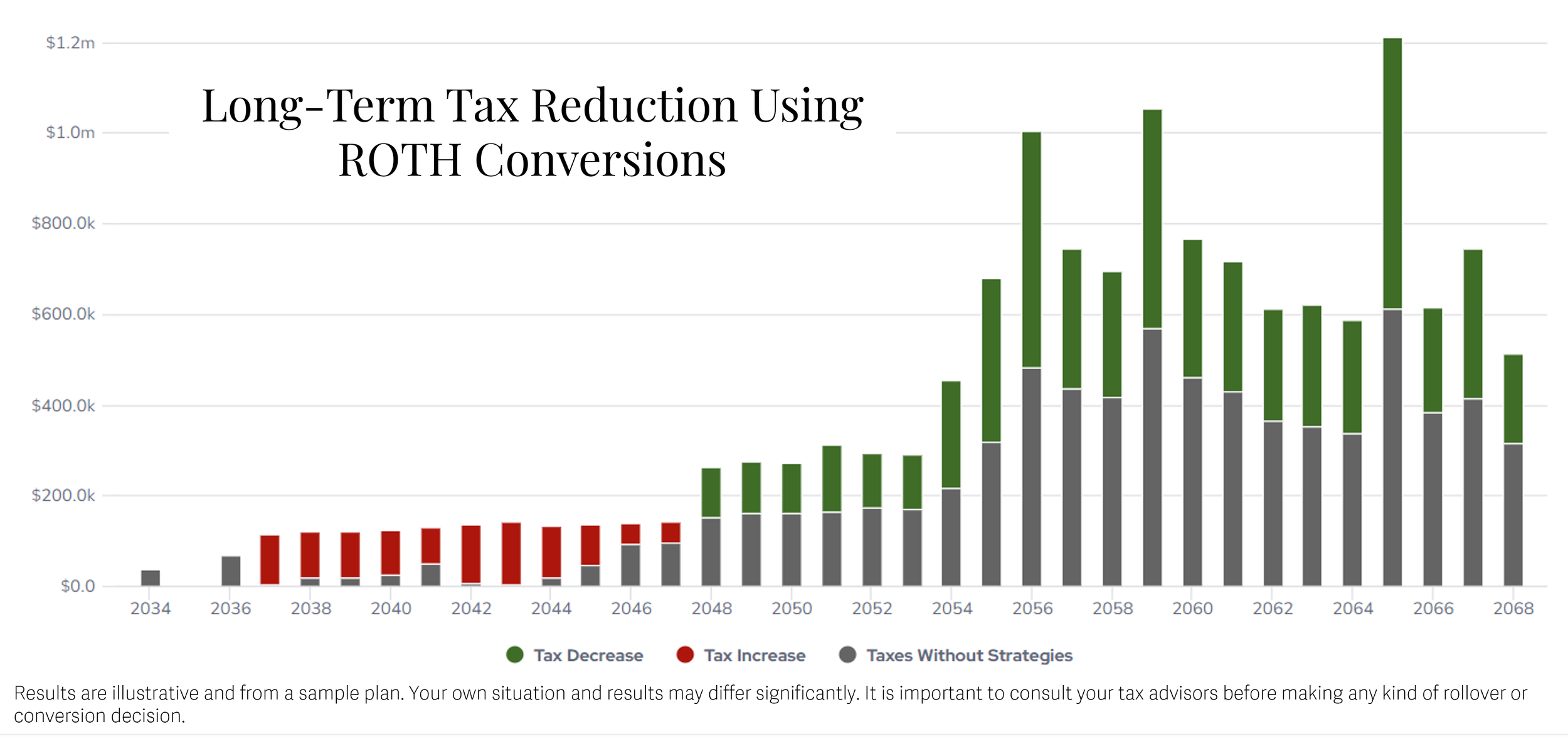

In the illustration, the vertical bars represent taxes in each year. A ROTH conversion increases taxes in the short-term (red bar) to reduce them in the long-term (green bars). Remember, the illustration is just that, an illustration from a sample plan. Your unique situation will impact the results.

It’s also worth noting that conversions typically occur over several years. The goal is to avoid moving into a significantly higher income tax bracket in any one year. By spreading it out, the total tax on the conversion is reduced.

ROTH Conversion Strategies:

If you are still working and are in a relatively low tax bracket, consider maxing out ROTH contributions to your employer’s 401k plan. Remember, you can contribute $23,000 in 2024 and your employer can match your contributions on top of that. No complex conversion required.

After you max out your ROTH contributions, or if you already have 401k assets, you may consider conversion strategies.

A ROTH conversion is simply rolling over assets from an existing 401k or IRA into a ROTH IRA and paying the taxes due on the withdrawal. Conversions work best when three things are true:

You are in a relatively low tax bracket

You are older than 59 ½ and can take IRA withdrawals without a tax penalty and

You can pay the taxes due from an outside account so that the full value can flow into a ROTH

If you are still working and earn more than the ROTH income limit ($230,000), a “Backdoor” or “Mega-Backdoor” ROTH strategy may help increase your ROTH contributions. This is a “backdoor” strategy because you make initial contributions to a traditional 401k or other retirement account and then roll the money over into a ROTH account. Contributions are not made directly to a ROTH, hence “the backdoor.” When using this strategy, you are not subject to the income limits for ROTH contributions, and you can contribute up to your 401k contribution limit, making this an effective strategy for high income earners.

Backdoor strategies work best when:

You are in a relatively low tax bracket and

You have made or can make after-tax contributions to your 401k plan

If you are considering a ROTH conversion, nearby are some of the key questions you need to answer.

It's important to note that there are complex rules around properly handling conversion transactions, especially if you have multiple retirement accounts. We recommend consulting with your tax advisors prior to attempting any kind of conversion. If you would like to evaluate whether conversions are ideal for your situation, start a conversion anytime.