Get Our Generational Wealth Roadmap

Everyone desires to build and steward their wealth across generations.

But where do you start?

How do you not spoil your kids in the process?

How should you transfer wealth to reduce taxes and empower the next generation?

In our Generational Wealth Roadmap, we share practical insights that you can start using today to build generational wealth. Our goal is to create a framework for opportunity, flexibility, and generosity in your family.

Reducing Taxes is a Long-Game

The best tax strategies often involve moving assets to the right legal structure and watching them grow over decades. Transferring your assets to the next generation often involves years of planning and execution across a group of professionals. Family partnerships, trusts, LLCs and other entities can magnify the impact of investment results over time.

Our wealth management team reviews your current structure and makes recommendations to improve your results in concert with your legal and tax advisors.

More on tax reduction strategies ->

Estate Planning = Springboard for Next Generation

Estate planning is not just for tax reduction; it builds the financial foundation for the next generation. Our wealth management team partners with attorneys and tax experts to build and execute an estate plan to accomplish your wealth transfer objectives. Estate planning often starts with tax goals, but it is also a powerful opportunity to empower the next generation of your family and build a legacy in the community. It’s not the end, it’s the beginning of the next generation.

Like tax planning, excellent estate and wealth transfer strategies often takes years to craft and execute. Our team will partner with you to help you make decisions around your wealth. Then we work with your attorneys to create and manage entities like trusts or partnerships to execute your plan.

Modern Fiduciary Approach To Generational Wealth Management

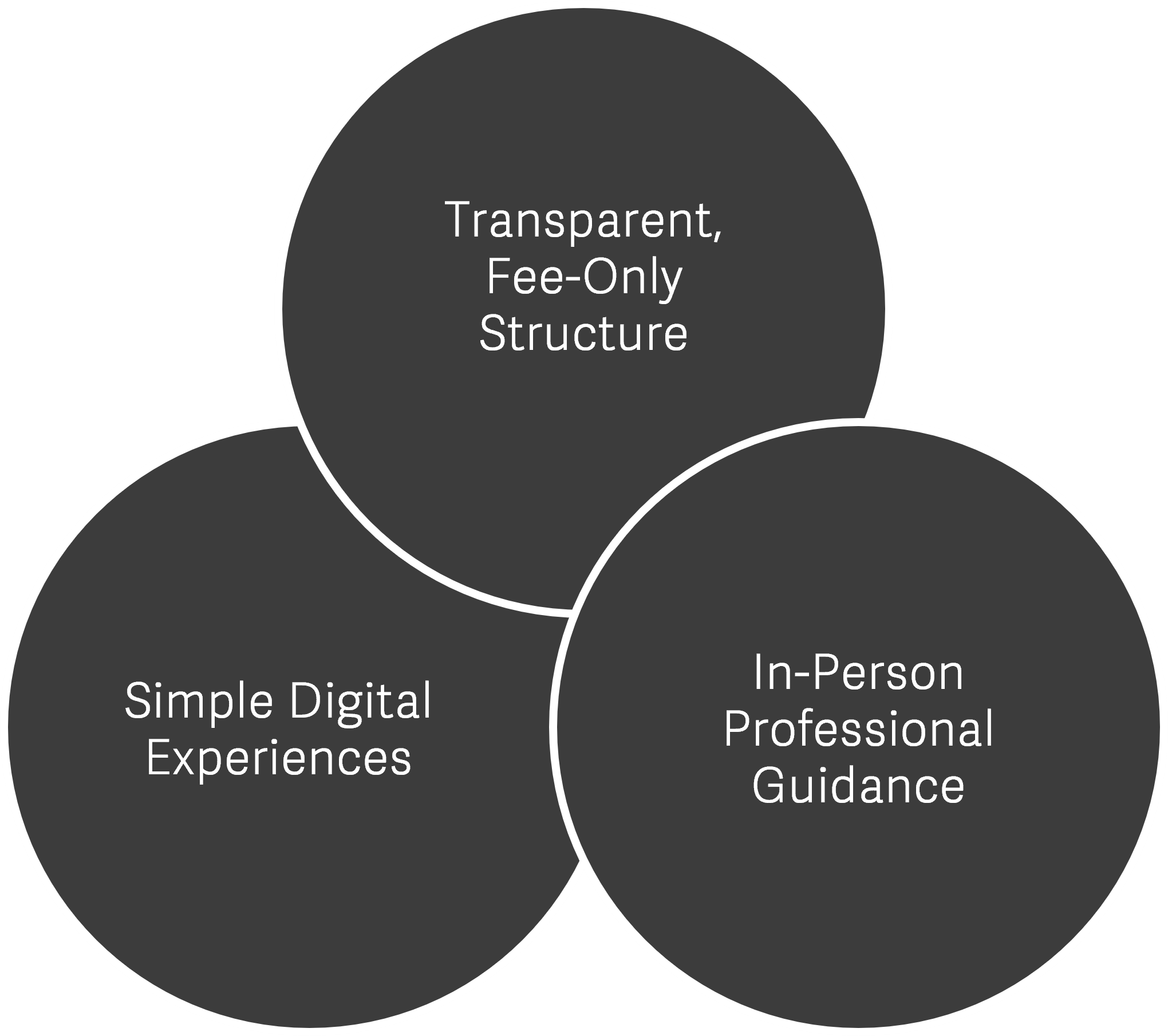

We are fiduciaries. That means we are financial advisors for generational families that combine a transparent, fee-only structure with simple digital experiences and in-person professional guidance to help clients achieve their goals. Our firm is based in Huntsville, but we work with clients nation wide.

Ready to Engage with Us?

3 Simple Steps:

Step 1: Start a conversation

We want to get to know you, your family and your concerns. In a 20-30 minute intro call, we ask questions to better understand your situation and goals.

If our services are a fit for your needs, we schedule a One-Page Plan meeting discuss a few initial insights unique to you and a proposal for working together.

Step 2: One-Page Plan Meeting

We deliver a “One-Page Plan” of recommendations that are yours to keep. We often address key concerns right here!

Discuss a proposal for a financial planning workshop to fully address your retirement, tax, investing and wealth planning concerns.

After addressing all of your questions, we give you time to consider whether you would like to work together.

Step 3: Financial Planning Workshop

We use digital tools to gather information and fully assess your financial situation.

We sit down together and leverage our expertise to fully address your biggest investing, tax and wealth planninng challenges.

Create a roadmap to achieve your goals and discuss how to implement your plan moving forward.